how to calculate sales tax in oklahoma

As a business owner selling taxable goods or services you act as an agent of the state of Oklahoma by collecting tax from purchasers and passing it along to the appropriate tax authority. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Oklahoma local counties cities and special.

Oklahoma Sales Tax Small Business Guide Truic

Sales tax data for Oklahoma was collected from here.

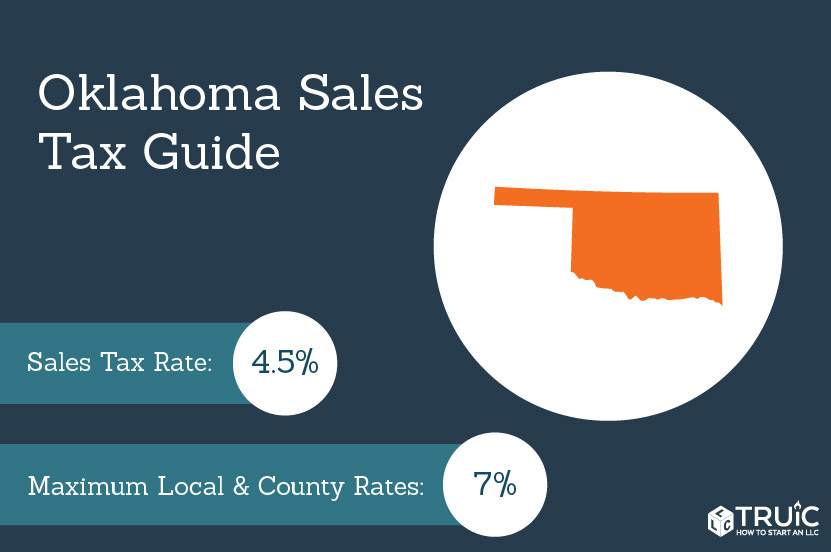

. Avalara provides supported pre-built integration. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. The easiest way to do this is by.

How to Calculate Oklahoma Sales Tax on a New Car. So whilst the Sales Tax Rate in Oklahoma is 45 you can actually pay anywhere between 45 and 10 depending on the local sales tax rate applied in the municipality. Sales Tax Rate s c l sr.

In Oklahoma this will always be 325. If you are not based in Oklahoma but have sales tax nexus in Oklahoma you are considered an Oklahoma remote seller. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top. The total sales tax rate in any given location can be broken down into state county city and special district rates. A customer living in Edmond Oklahoma finds Steves eBay page and purchases a 350 pair of headphones.

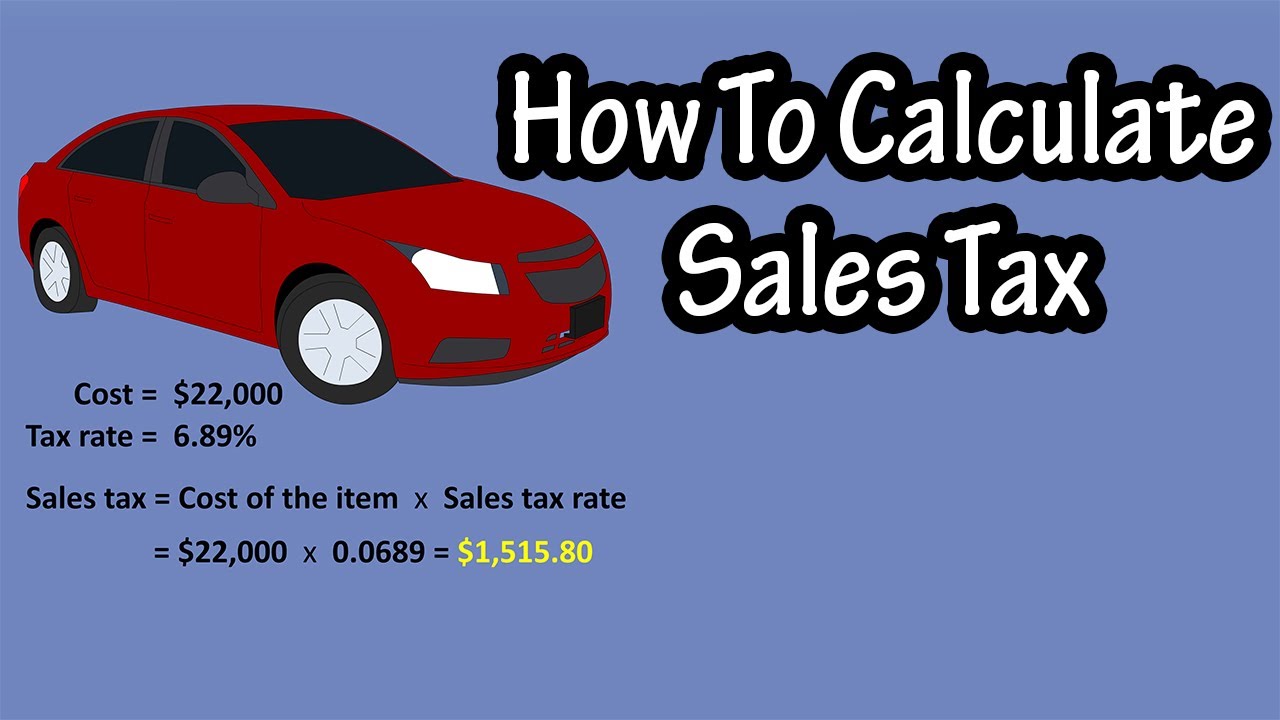

Sales Tax Calculator Sales Tax Table. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

31 rows The latest sales tax rates for cities in Oklahoma OK state. Ad Download Or Email STS20002 More Fillable Forms Register and Subscribe Now. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

As a result the combined sales tax rate can vary quite a bit. Currently combined sales tax rates in Oklahoma range from 45 percent to 115 percent depending on the location of the sale. For example in Oklahoma City the combined rate is 8375 and in Muskogee it is 915.

However in addition to that rate Oklahoma has the fifth-highest local sales taxes in the country tied with Louisiana the combined city and county rates are as high as 7. You can lookup Oklahoma city and county sales tax. Alone that would be the 14th-lowest rate in the country.

Well speaking of Oklahoma it imposes a sales tax of 45. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship to address.

The Tulsa Oklahoma Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Tulsa. The state sales tax rate in Oklahoma is 450. Use our OkCARS - Sales and Excise Tax Estimator to help determine how much sales and excise tax you will pay on your new purchase.

Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. We would like to show you a description here but the site wont allow us. Multiply the vehicle price after trade-ins and incentives by the sales tax fee.

Home is a 3 bed 10 bath property. The maximum local tax rate allowed by Oklahoma law is 65. However there are additional tax rates in both the counties and major cities of Oklahoma.

For example imagine you are purchasing a vehicle for 50000 with the state sales tax of 325. Depending on local municipalities the total tax rate can be as high as 115. If this rate has been updated locally please contact us and we will update.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. The sales tax rate for Enid was updated for the 2020 tax year this is the current sales tax rate we are using in the Enid Oklahoma Sales Tax Comparison Calculator for 202223. Oklahoma excise tax provided they title and register in their state of residence.

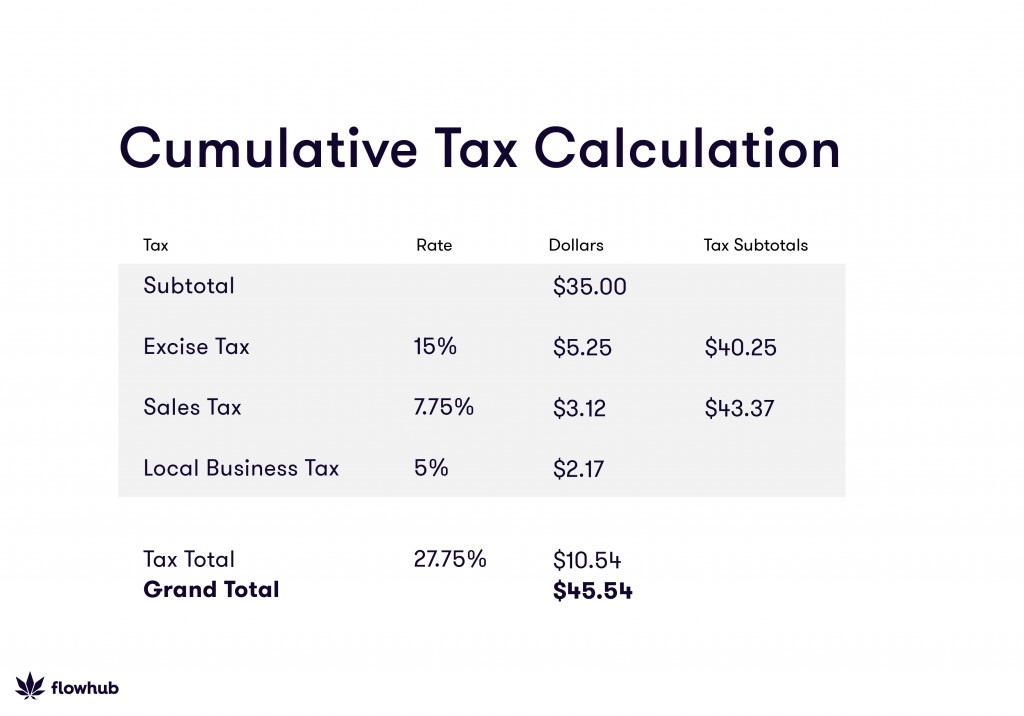

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. When calculating the sales tax for this purchase Steve applies the 45 state tax rate for Oklahoma plus 375 for Edmonds city tax rate.

Municipal governments in Oklahoma are also allowed to collect a local-option sales tax that ranges from 035 to 7 across the state with an average local tax of 4242 for a total of 8742 when combined with the state sales tax. Rates include state county and city taxes. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11.

Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition. Oklahoma Sales Tax Rates. An additional tax might be imposed by the counties which could be different for various counties and cities but generally.

How much is sales tax in Enid in Oklahoma. The state general sales tax rate of oklahoma is 45. At a total sales tax rate of 825 the total cost is 37888 2888 sales tax.

087 average effective rate. Please select a specific location in Oklahoma from the list below for specific Oklahoma Sales Tax Rates for each location in 2022 or calculate. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition.

Find your Oklahoma combined state and local tax rate. There are several additional factors involved as well. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

The base sales tax rate in Oklahoma is 45. Sales tax in edmond oklahoma is calculated using the following formula. Choose the Sales Tax Rate from the drop-down list.

Sales tax in Enid Oklahoma is currently 91. Oklahoma Sales Tax Guide And Calculator 2022 Taxjar Tulsa County - 0367. The Oklahoma state sales tax rate is 45.

The base sales tax rate in Oklahoma is 45. The base state sales tax rate in Oklahoma is 45. Other local-level tax rates in the state of Oklahoma are quite complex compared against local-level tax rates in other states.

Most vehicles all terrain vehicles boats or outboard motors are assessed excise tax on the basis of. Oklahoma has a lower state sales tax than 885. 2020 rates included for use while preparing your income tax deduction.

Oklahoma Sales Tax. If youve opened this page and reading this chances are you are living in Oklahoma and you intend to know the sales tax rate right. Oklahoma sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

The Oklahoma OK state sales tax rate is currently 45.

How To Calculate Sales Tax A Simple Guide Bench Accounting

Pin On Internet Financial Logo

Quarterly Tax Calculator Calculate Estimated Taxes

How To Calculate Sales Tax Definition Formula Example

How To Calculate Sales Tax For Your Online Store

Markups Markdowns Inb Foldables Activities Seventh Grade Math Teacher Info Math Journals

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

2x Thayers Facial Toner Rose Petal Unscented Witch Hazel W Aloe Vera 12oz Ebay In 2022 Facial Toner Unscented Aloe Vera

Braun Forehead Thermometer Bfh175 White Walmart Com Braun Forehead Thermometer Forehead Thermometer Forehead

How To Calculate Sales Tax Video Lesson Transcript Study Com

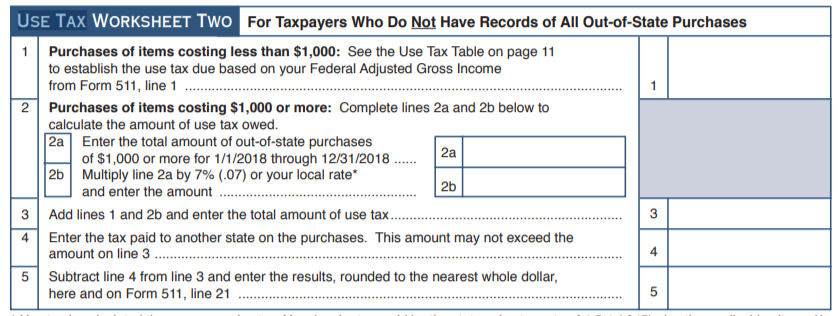

Do I Owe Oklahoma Use Tax Support

How To Calculate Sales Tax On Calculator Easy Way Youtube

Property Tax How To Calculate Local Considerations

How To Calculate Sales Tax Definition Formula Example

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube